Money talks || Cures for a lean purse I4 mins read

Hey people!

Hope you’ve been well since our last post?

In the debut money talks post, I promised to share some tips on savings and investment over the next few weeks.

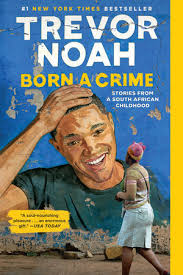

Most of the principles I’ll be sharing are gotten from the time-trusted book, The Richest Man in Babylon by George S. Clason. Babylon is said to have been the wealthiest nation in its time, with lots of wealthy persons inhabiting it. It is also home to one of the seven wonders of the world, the hanging gardens of Babylon.

Although I’ve been guided by most of these principles way before I read the book, everything was really broken down here, explaining financial concepts using storytelling. If you want to go deeper than I’ll do in this series of posts, then I’d recommend that you read this book (you can finish it in hours – it’s that short and interesting).

In today’s post, we’ll be talking about the cures for a lean purse. The cures for a lean purse are a set of rules concerning personal finance outlined in The Richest Man in Babylon. These rules were narrated by Arkad, the richest man in Babylon who started from nothing in the rich city of Babylon. The rules are said to have guided men in those days towards acquiring and retaining riches. I’ll be sharing some of these rules, expounding a bit on them and how they can be applied to us in this modern day. According to Arkad, there are 7 cures for a lean purse and these will be discussed in bits over the next few posts. If you’re yet to subscribe, kindly do so you wouldn’t miss out on anything.

#1 Cure for a lean purse: ‘Start thy purse to fatten.’

How do you fatten your purse? By putting money in it, simple. The idea is to set aside some money at intervals, essentially for savings. As explained in the book, you can see this as paying yourself just like you pay the tailor, restaurant and all others. The way to make this work well is to ensure that you pay yourself first, before any other person. As Arkad tells us in the book, a part of all you earn is yours to keep.

Also, rather than setting a particular amount, it’s always better to set a percentage. This helps you adjust the actual amount to suit your income level. For instance, if you’ve been saving 5,000 naira monthly from a 50,000 naira salary when the salary jumps to 100,000 naira, you might find it difficult to adjust your mindset to increase your savings amount and stay at 5,000 naira. However, if you are using a percentage system, it becomes easier to increase your savings. A minimum savings of 10% of your income is usually advised but this can go higher depending on your personal preference.

'A part of all you earn is yours to keep.' Arkad, the richest man in Babylon. Share on XSaving has gotten easier in this age as there are now various platforms which one can use to automate savings. Here is one of such you can check out. You can automate your savings so that you don’t have to worry about forgetting. You also get interests on your savings. I already talked a bit here about the benefits of saving on this kind of platform as opposed to a wooden piggybank or the likes.

#2 Cure for a lean purse: ‘Control thy expenditure.‘

The next thing after saving is to ensure that you do all you can to avoid dipping into the savings. This is where budgeting comes in. Some might even argue that budgeting comes before saving.

Budgeting is basically controlling your money, telling it where to go and how much can go there. If you don’t control your money, it can go haywire. Once again, the easier way to budget is to set certain percentages of your income rather than having fixed amounts.

The 50/30/20 rule of allocating funds is usually advised. I’d rearrange this to 20/50/30 in order of importance. This means 20% of your income goes to savings and investment, 50% goes to your needs (housing feeding, clothing, etc) and the remaining 30% goes to your wants (eating out, games and the likes).

You can always determine what your wants and needs are as what can be a need for me might just be a want for you and vice versa. Also, you can adjust the percentages to suit what you want to achieve. There are other ways of budgeting such as spending what is left after saving and putting different amounts in different envelopes. I think all stem from the percentage rule which is still the best in my opinion.

Keep this in mind when budgeting – Expenses expand to meet income, so if you’re not careful you’ll lose control over your money.

'What each of us calls our 'necessary expenses' will always grow to equal our incomes unless we protest to the contrary... All men are burdened with more desires than can be gratified.' - Arkad, The Richest Man in Babylon Share on X‘What each of us calls our ‘necessary expenses’ will always grow to equal our incomes unless we protest to the contrary… All men are burdened with more desires than can be gratified.’

Arkad, The Richest Man in Babylon.

To make your budgeting easier, you have to know what you spend on which can be done by tracking your expenses. You can decide to track your expenses for a week or more before committing to a fixed budget. Tracking your expenses also helps you plug any leakage in your finances, readjusting your spending to suit your income. There are several applications out there which help with tracking expenses. Some people also use excel spreadsheets to track theirs.

Those are the 2 cures for today. I hope this has inspired you to take your personal finances more seriously. Check back next Friday for the next 2 cures, or subscribe to get notified instantly when the post goes up. Just before we sign out for today, here’s something Arkad has for us:

‘Enjoy life while you are here. Do not overstrain or try to save too much. If one-tenth of all you earn is as much as you can comfortably keep, be content to keep this portion. Live otherwise according to your income and let not yourself get niggardly and afraid to spend. Life is good and life is rich with things worthwhile and things to enjoy.’

Arkad, The Richest Man in Babylon.

So while we should save and plan for the future, let’s remember to live now, enjoy life. As my friend would say – Chop life, no let life chop you!

'Enjoy life while you are here. Do not overstrain or try to save too much... Life is good and life is rich with things worthwhile and things to enjoy' - Arkad. Share on XDo you already follow some of these principles? How has it been? Do you have some tips to share? Let me know in the comments section below. (Your comments add a spark to my day so I’d really like to hear from you!)

3 Comments

Pingback:

Pingback:

Pingback: